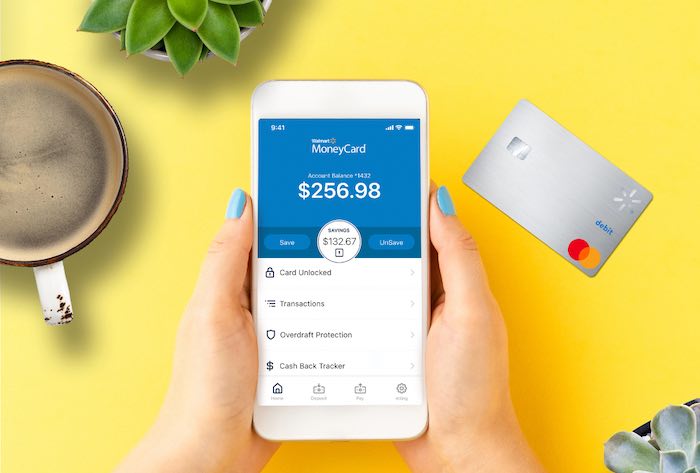

Walmart Money Card helps millions of Americans simplify and more conveniently manage their day-to-day lives by helping them with basic routines. It works just like a Visa credit card, but with a lot of added safety, efficiency, and benefits. There is no limit to where you can use Walmart Money Card. You can use it anywhere Visa debit cards are accepted.

If you want to make recurring monthly payments for your auto insurance, you can do so with Money Card. Besides, you can send money orders and get paper checks. Using these cards, you can also send funds to friends and family anywhere in the country. Walmart.com and the Walmart app allow you to earn cash-back rewards when you shop online, at Walmart fuel stations, or at Walmart retail stores. If you are worried about load your Walmart Money Card, then Walmart stores are not your only option. There are many other ways that I am going to mention here to make your life easier.

Near me places to load my Walmart Money Card besides the Walmart store

With Walmart’s Money Card, you can fund the account in several ways without stepping into a Walmart store. It’s easy to load the Money Card at store registers, Walmart MoneyCenters, or your IRS tax refund.

How to load Walmart Money Card besides the Walmart store?

The Walmart Money Card offers many options for load money onto the Card besides Walmart stores, which is one of its most attractive features. By showing you the easy and effective methods for reloading your Walmart Money Card, we’ll make it easier for you to understand how to do it.

Cash Deposit (Cash Reload Options)

If you want a Money Card reloading option other than Walmart, then the Cash Deposit through MoneyPak is convenient, I must say. You can reload your Money Card through MoneyPak at a nearby store. To do that, you need to create a MoneyPak account at MoneyPak.com. Then you can buy a MoneyPak and add $20 to $500 at participating retailers for $5.95 as a charge. Besides Walmart, other retail locations where MoneyPak is available are CVS, Dollar General, Dollar Tree, Family Dollar, Kroger, Rite Aid, Safeway, 7-Eleven, and Walgreens. Make sure your Walmart Money Card is activated and personalized with the recipient’s name before using MoneyPak.

Another option is Tax Refund. This way, you don’t need to walk to a Walmart store to reload your Money Card account. If you file your income taxes electronically, you can get the refunds directly in your Walmart Money Card without any unnecessary formalities. You can take advantage of this service for free! Using this service is as simple as sending Walmart your card information and mobile phone number. You will receive a direct-deposit number from Walmart that you can use to fill out your tax forms.

Reload Walmart Money Card with Direct Deposit

Whether it’s a paycheck or government benefits, you can direct deposit them all to your Walmart Money Card. When that happens, ensure the employer notifies the bank about direct deposits about 2 days before payday.

- Find out if your payroll or benefits provider offers direct deposit.

- Then, collect your direct deposit account number and bank routing number. You can log in to your Money Card account or request the info via text message.

- Forward your direct deposit account and bank routing number to your payroll or benefits provider.

- Double-check that the name on file with your employer or benefits provider matches what’s on your account.

A significant advantage of direct deposit is that it’s free. Besides, you can deposit a part or all of your checks.

Reload Money Card from a Bank Account

It’s always wise to know the alternative options to get funds from other sources besides stores. The good thing is that transferring funds from your bank account to Walmart Money Card is one of the options. Just need to set up the transfer on your bank’s website by submitting your Walmart Money Card account and routing number. Here’s what you need to know to transfer money from a bank account to your Money Card account.

- Find the account number and routing number for your Money Card : As Money Card is a prepaid debit card, Green Dot Bank issues that Card as major banks do with prepaid debit cards. That is why every Money Card account has the account number and the routing number, which you will first have to get from the issuing bank to set up the transfer.

- Link your bank account to your Prepaid Card : Just access your bank account from the website and click “Transfers.” Then you’ll see how to add your prepaid Card, including your routing and prepaid account numbers. Your bank account will then get your Money Card information once you enter it.

- Try a Test Deposit : The linking bank will send test deposits to your Money Card account to confirm your account info. Most banks send two test deposits, usually less than a dollar. So, you don’t need to worry about the amount. If the transfer goes well, you are ready to go.

- Start your transfer : Adding your prepaid debit card to your bank account means you can now transfer money from your bank account to your prepaid debit card.

You don’t have to pay for reloads as Money Card keeps it charge-free. But you may have to pay your bank for this.

Reload Money Card with Check Deposit

The Walmart Money Card mobile app lets you quickly deposit checks into your MoneyCard account. Money Card accepts all checks in U.S. dollars. This service isn’t available in New Jersey, New York, or Rhode Island, so you can’t use it there. And you will have to know the types of checks that Walmart MoneyCard accepts. Those are:

Personal checks were written out to you, Payroll checks, Insurance agency checks, Money orders, Cashier’s checks, Rebate checks, Stock dividend checks, U.S. Government-issued checks such as Tax refunds, and Federal, state, and municipal government checks. Here’s how to use the app to deposit a check:

- Launch the app and sign in with your account credentials.

- From the interface, tap on DEPOSIT and then tap on the DEPOSIT A CHECK option.

- Be sure that the check is allotted for you

- Write “for mobile deposit only” back of the check and below that sign above Your Signature option.

- Then follow the prompts.

You’ll get the money within 5 business days after depositing the check. You don’t have to pay for checking deposits using the mobile app. Once you deposit a check through the mobile app, you can neither cancel the transaction nor cash the check elsewhere.

Card to Card Transfer

Card-to-card transfers are another way to load money onto your Walmart Money card. You don’t have to pay to reload fees at Walmart Rapid Reload. If you want to do this, get a friend or family member to transfer money from their Walmart MoneyCard to yours. In that case, they must have a Money Card account. You can do this with Card-to-Card Transfers. This is how it works:

- Your friends or family need to provide Walmart Money Card with your email address or phone number and the amount they want to send you.

- Walmart Money Card takes that amount from that sender account and starts transferring that amount to your Money Card account.

- You’ll get the money in your Walmart Money Card account within one business day.

Read Also : Does Zelle Work With Walmart Money Card

Can Someone Else Put Money on My Walmart Money Card

Yes, your friends and family members can load your Walmart Money Card for you. If someone else wants to deposit money on your Walmart Money Card, they can do so by bank transfer using your routing and account numbers. But if they don’t want a bank transfer, then for $5.95, they can buy a MoneyPak at most retailers. This will deposit cash into your account instead of doing a bank transfer.

Find the Routing and Account Numbers for my Walmart Money Card

Once you register for your Walmart Money Card account, you can get your account and routing number from several sources. You can get your account and routing number simply by texting “D.D.” to 37267, logging into the app, or calling Cardholder Customer Service at 1-877-937-4098. Keep in mind that there’s a difference between the account and your card numbers.

The Account Balance Limit on a Walmart Money Card

You can load cash to your Card for up to $3,000 daily, but the in-store reload limit also applies. And always keep in mind that you can’t load cash when the available balance on your Card exceeds $3,000. And on any given calendar day, you can’t do more than $3,000 worth of transactions. But you can store up to $7,500 on the Card. Reload requests are subject to Walmart’s sole discretion.

Does a Walmart Money Card Have Overdraft Protection?

Yes, Walmart Money Card has overdraft protection only if you choose to opt-in. You will have overdraft coverage depending on how much you deposit. According to the Walmart policy on overdraft protection, any direct deposit in your account gets you $10 in overdraft protection. The calculation of the policy says that if you receive two direct deposits totalling $200 or higher within 35 days, you’ll be eligible for $100 of overdraft coverage. If you get two direct deposits totalling $400 or higher within 35 days, you will get $200 in overdraft protection.

Can I reload my Money Card with a Credit Card?

It’s not possible to load your Walmart Money Card with a credit card. Since Money Card is a prepaid debit card, you can’t reload it with a credit card.

Can I reload my Money Card online?

For its users’ convenience, Walmart keeps its features up to date so anyone can load their Walmart Money Card online. With Walmart Money Card, you can transfer money from your bank account to your Money Card account and reload your Card online.