BankMobile is an online bank that targets Millennials, college students, and other tech-savvy customers who are looking to avoid bank fees. It is a branchless bank that offers mobile banking services and has a checking account just for students. It’s convenient for students to manage their finances without incurring expenses. Using BankMobile, students have saved about $100 million on banking fees. The company’s website makes you wonder if the company is real or a scam. Even though it’s not as big as other banks, it’s still growing. You won’t pay a monthly fee for a BankMobile VIBE checking account, and…

Browsing: Banking

Venmo is a well-known PayPal-powered payment app that lets you send and receive money. Venmo also has a debit card you can use at ATMs. However, if you’re thinking you’ll be able to add cash to your Venmo card pretty much anywhere, then you might be a little mistaken. Banks and fintech companies, like Chime and Cashapp, let you reload cash at CVS, Walmart, and ATMs. It’s possible to find some people who claim Venmo has the same feature, but it’s not an official feature. It’s been reported that people can reload their Venmo card using cash at Walgreens, Walmart,…

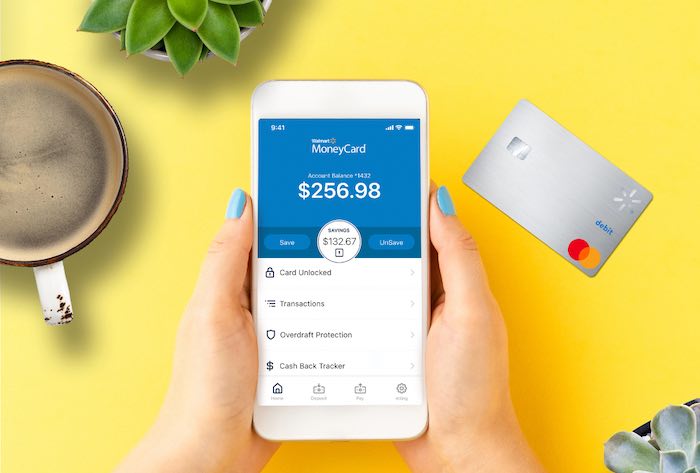

Walmart introduced MoneyCard as a convenient debit for users to make financial deals easy and fast anywhere they want. A MoneyCard user can purchase and withdraw cash anywhere Visa or Mastercard is accepted. So, more people are getting used to this debit card because of the convenient usage and dimensional options. But more people are also looking for alternative money withdraw options from Walmart MoneyCard without card. It’s either because they lost their card, or expired, or maybe they didn’t receive the card yet. Walmart users or new users can apply for the MoneyCard or purchase it from the stores.…

Transferring money to a bank account is one of the many transactions you can perform with the Netspend prepaid debit card. Prepaid cards, debit cards, and bill payment methods from Netspend enable you to retrieve funds from ATMs, transfer funds to a bank account, and pay online. The ability to transfer funds to a bank account is one of the benefits of using Netspend since this allows access to funds for other uses. Your bank account may need money for savings or to repay a loan, among other things. You only need to transfer the money from your Netspend account…

Walmart Money Card helps millions of Americans simplify and more conveniently manage their day-to-day lives by helping them with basic routines. It works just like a Visa credit card, but with a lot of added safety, efficiency, and benefits. There is no limit to where you can use Walmart Money Card. You can use it anywhere Visa debit cards are accepted. If you want to make recurring monthly payments for your auto insurance, you can do so with Money Card. Besides, you can send money orders and get paper checks. Using these cards, you can also send funds to friends…

Today, transferring funds between accounts does not require us to wait in the bank queue. The Netspend’s Skylight Card has that magical feature to enjoy on your smartphone. You’ll love how quickly and conveniently transferring money with a Skylight card is. There are several options for bank transfers, so you can pick one that works for you. Netspend cards don’t let you transfer money to other banks directly, so you have to follow some additional steps. Don’t worry; all the steps you need to follow are online. So, you can prepare the transferring procedure online. You only need a smartphone…

You can use the Cash App virtually with any credit or prepaid card. There are certain limitations, though. Cash App does not accept some cards, so they shouldn’t be used for deposits. It does not accept business debit cards, ATM cards, or PayPal. The Cash App has a few limitations you should be aware of, whatever Cash App allows you to link someone else’s debit card. But you can add only one account from one specific bank. In summary, you can add one bank account, one debit card, and one credit card at a time. Suppose you want to add…

The resources and benefits of Forest National Bank make it a great combination of national and local banks. With over 788 branches in 17 states, various checking, savings, CD, IRA, and MMA accounts, and updated online banking, it can compete with the big guys. Woodforest has fewer customers and lowers costs as a smaller bank, so it feels more like a “hometown” bank. Through an ATM, customers can make withdrawals, deposits, or any other transactions just like with a bank teller. They’re usually located at financial institutions or elsewhere. Here you will find the essential information on Woodforest Bank ATM…

Afterpay and other buy now pay later plans have become more popular, especially since people have been shopping at home more. Shopping and paying online have been easy with Afterpay. Paying off your purchases on time is possible if you’re disciplined. You can shop and pay interest-free with Afterpay. So, if you want to buy something online, but your direct deposit isn’t there yet, you can still do it. On the contrary, Chime is a financial technology company whose banking facilities are licensed by the Central National Bank. Chime believes everyone should have financial peace of mind. So, they’re building…

A Buy Now Pay Later App is a blessing when you are in financial hardship. Afterpay lets a user order any essential things from listed merchants and splits the bill into four installments so that the user does not need to feel the burden to pay the amount. The business model was designed to offer free services to the customers until they pay on time. Afterpay does not impose any fees until a customer pays on time. But If it fails, then Afterpay starts charging late fees. The overdue pay option works in favor of the customer, but normally Afterpay…